Brookings Impact Bond Snapshot, 1 January 2019[i]

Funding for development is changing. Payment by results and contracts were already shaping expectations of grants and mainstream funding. Now new funding modalities such as Development Impact Bonds (DIBs), blended finance and Multi-Donor Trust Funds (MDTFs) are reinforcing this trend. Specific programmes may be well suited to such approaches, increasing efficiency and scale, leveraging investment funding and incentivising innovation. They may rebalance risks for development actors and governments, but they also raise new questions around power, funding, policy and continuity. We explore the modalities and considerations.

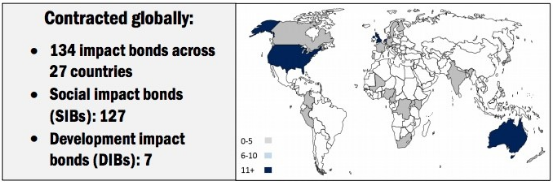

Brookings Global Impact Bond Database tracked 134 impact bonds as either completed or in implementation by the end of 2018, mostly Social Impact Bonds. Specifically, in development, there are seven active Development Impact Bonds DIBs currently. Outcomes-based programmes are financed by risk capital from social investors with an ‘outcome funder’ (e.g. a donor or government) paying back the investment on end results. The approach is suited to programmes with established indicators and impact results, ready for scale-up, particularly where they are flexible and adaptive to specific contexts. Experience of the current DIBs suggests teams need to be prepared to invest time and money in measurement and reporting systems and close coordination with partners to succeed. DIBs are less suited for longer-term programming and can carry high start-up costs for investment and systems [ii].

Blended Finance can leverage significant funding for SDG delivery and focus private investments on development outcomes. This is a large market ($50bn), forecast to double [iii]. Development finance in the shape of loan guarantees or mezzanine loans (governments absorb impact of defaults) de-risk private investments, attracting finance for development projects. But large infrastructure projects attractive to investors may not have development benefits for communities and marginalised indviduals [iv], and incentives are biased to middle rather than low-income countries [v].

Multidonor trust funds are well established (MDTFs exist for disaster response, global development and country projects), with pooled funds from multiple donors. Benefits include a commitment to long term coordinated programming between actors and funders and reduced entry costs for smaller donors. Collaboration in larger MDTFs promote common policy and practice. The challenge is to make sure donor funding preferences and budget lines do not work against shared objectives and funds [vi].

New financing modalities can help leverage new funding and were applied well have the potential to increase focus on outcomes and performance. However, it’s important to address issues head-on, including power, funding, policy and continuity.

- Power imbalance: Power dynamics and power imbalances between international investors and governments in countries. More evidence on results and impacts for people and communities in poverty are needed [vii].

- Funding substitution: Do new funding mechanics generate incremental revenue streams, or simply substitute traditional ones? A particular concern for private foundations and corporate investments. Again more data is required.

- Policy Framing: More policy and institutional frameworks are needed to guarantee positive development impacts from private financing flows [viii]. Clearer international criteria and definitions for financing platforms could assist (e.g. Green criteria for Green Bonds [ix]).

- Continuity: Annual budgeting cycles for investors challenge continuity and long–term interventions [x]. Investment funding for pilots could be as well used in proven, established programmes.

As traditional grant funding contracts and contorts, collaborating in new modalities of finance offer exciting new pathways for funding development. Although evaluations of alternative financing methods are positive, more work needs to be done to assess future potential and long–term impact.

By Jane Thurlow

[i] https://www.brookings.edu/wp-content/uploads/2019/01/Impact-Bonds-Snapshot-January-2019.pdf

[ii] Impact Bonds in Developing Countries: Early Learnings from the Field Brookings Institute, September 2017

[iii] Blended Finance TaskForce

[iv] Development Initiatives, Blended finance: Understanding its potential for Agenda 2030, 2018 (http://devinit.org/post/blended-finance-understanding-its-potential/)

[v] Investments to end poverty 2018 report, Development Initiatives

[vi] 2006 Review of Post-Crisis Multi-Donor Trust Funds: Key Findings, Joint Donor and World Bank Review Norway, Canada, United Kingdom, and The Netherlands. World Bank Conflict Prevention and Reconstruction Unit, Trust Funds Operations Unit, Fragile States Unit

[vii] Impact Bonds in Developing Countries: Early Learnings from the Field Brookings Institute, September 2017

[viii] Blended Task Force

[ix] Bank Track Calls for Strengthening of Green Bond Principles

https://www.banktrack.org/article/banktrack_calls_for_strengthening_of_green_bond_principles

[viii] Impact Bonds in Developing Countries: Early Learnings from the Field Brookings Institute, September 2017

[x] Impact Bonds in Developing Countries: Early Learnings from the Field Brookings Institute, September 2017